Managing Accounts in BlockPeer Books

Understanding Account Types

Asset Accounts

Assets are things your business owns with value.

Current Assets (Can convert to cash within 1 year)

- Cash

- Bank accounts

- Wallets (crypto and fiat)

- Receivables (money owed to you)

- Inventory

Fixed Assets (Long-term value)

- Equipment

- Property

- Vehicles

- Furniture

- Investments

Liability Accounts

Liabilities are amounts you owe.

Current Liabilities (Due within 1 year)

- Credit card balances

- Accounts payable

- Short-term loans

- Deferred revenue

Long-term Liabilities

- Mortgages

- Long-term loans

- Bonds

Equity Accounts

Equity is what's left after liabilities.

- Contributed capital

- Retained earnings

- Dividends paid

- Common stock

Income Accounts

Money coming in.

- Sales revenue

- Service revenue

- Interest income

- Rental income

- Other income

Expense Accounts

Money going out.

- Cost of goods sold

- Salaries

- Rent

- Utilities

- Office supplies

- Travel

- Professional fees

Creating New Accounts

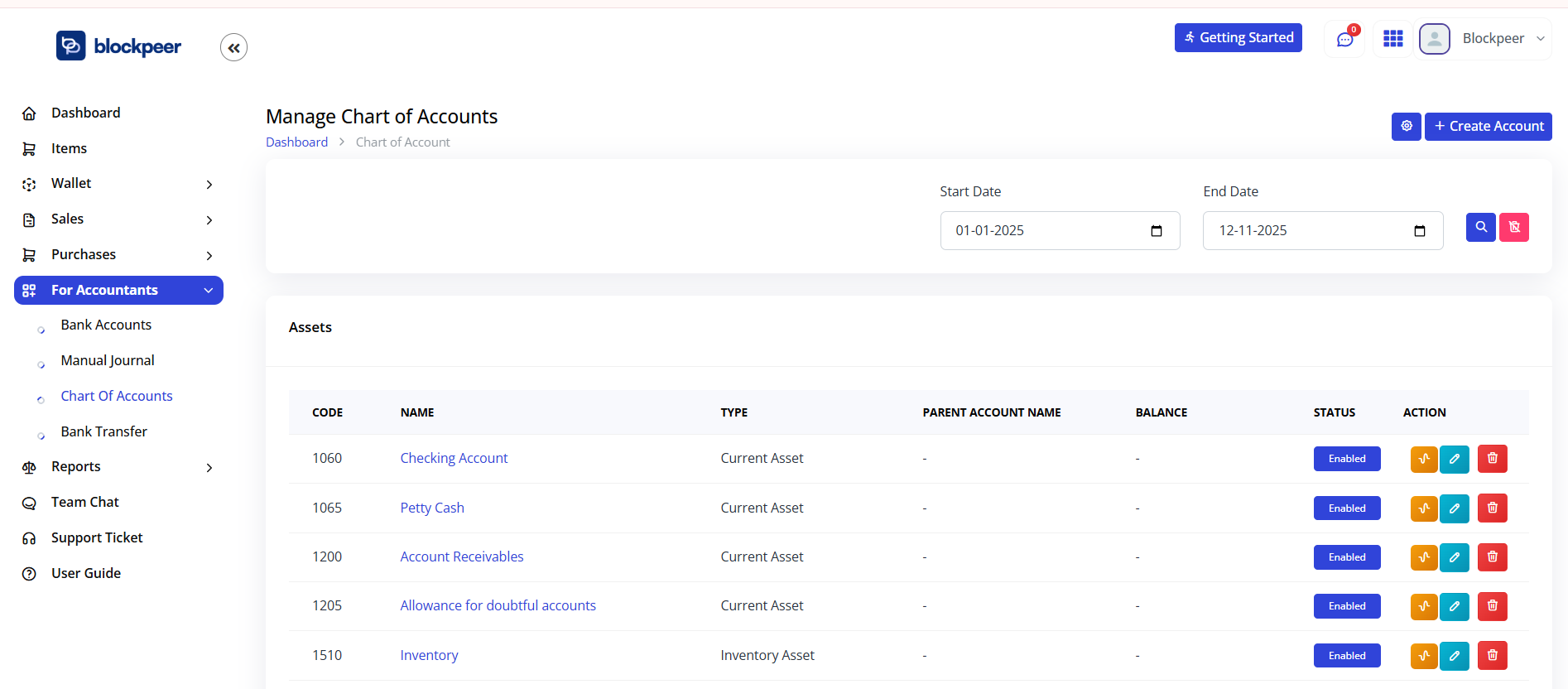

Step 1: Navigate to Chart of Accounts

- Go to Accounting → Chart of Accounts

- See all existing accounts organized by type

- Click + Add Account button

Step 2: Enter Account Information

-

Account Name: Clear, descriptive name

- Good: "Ethereum Holdings", "Client Retainers", "Monthly Office Rent"

- Bad: "Misc", "Account 1", "Various"

-

Account Type: Select from list

- Asset, Liability, Equity, Income, Expense

- Sub-type will appear (e.g., Asset → Current Asset)

-

Account Number (optional)

- Use numbering system: 1000-1999 (Assets), 2000-2999 (Liabilities), etc.

- Helps organize large charts of accounts

- Must be unique

-

Description: Optional explanation

- Example: "Operational wallet for receiving client payments"

-

Currency:

- Default uses organization currency

- Can override for multi-currency accounts

- Example: If organization default is USD, this account can be in EUR

-

Parent Account (optional)

- If creating sub-account, select parent

- Example: Parent "Crypto Holdings" → Sub "Bitcoin Holdings"

-

Status: Active or Inactive

Step 3: Set Up Account Parameters

Depending on account type:

For Asset Accounts:

- Track cost basis? (For crypto)

- Depreciable? (For equipment)

- Depreciation method: Straight-line, accelerated, etc.

For Income/Expense Accounts:

- Tax category? (For tax reporting)

- Department? (For cost allocation)

Step 4: Save and Confirm

- Click Create Account

- Account appears in Chart of Accounts

- Can now use in transactions

Organizing Accounts

Account Operations

View Account Details

- Go to Accounting → Chart of Accounts

- Find the account

- Click the account name

- See:

- Current balance

- Transaction history

- Sub-accounts (if any)

- Recent activity

Edit Account

- From Chart of Accounts, find account

- Click Edit (pencil icon)

- Can modify:

- Account name

- Description

- Currency

- Parent account

- Status

- Click Save

Deactivate Account

When you stop using an account:

- Go to Accounting → Chart of Accounts

- Find account

- Click Edit

- Change Status to "Inactive"

- Click Save

Important: Cannot delete accounts with transaction history (for audit trail). Instead, deactivate.

Set Up Sub-Accounts

For detailed tracking, create sub-accounts:

Example: Crypto Holdings

Crypto Holdings (Parent) ├── Bitcoin Holdings (Sub) ├── Ethereum Holdings (Sub) └── Stablecoin Holdings (Sub)

Steps:

- Create parent account "Crypto Holdings"

- Create sub-accounts (Bitcoin, Ethereum, etc.)

- When creating sub, select parent as "Crypto Holdings"

- In reports, can view by parent or drill down to subs

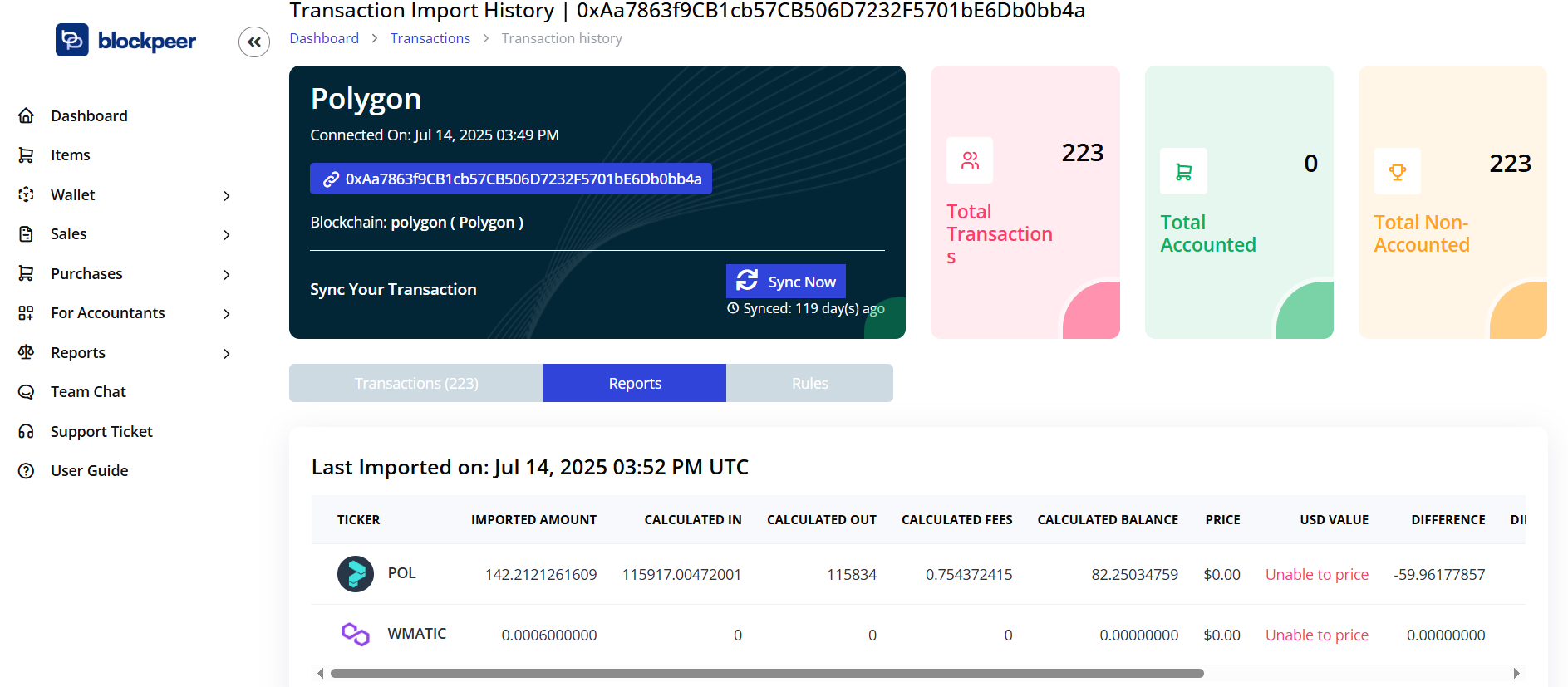

Link Wallets to Accounts

Connect wallets to accounts for automatic tracking:

Connect wallets to accounts for automatic tracking:

- Go to Wallets → Blockchain Import → Select wallet

- Click on Create Entry

- Choose the transaction entry (e.g., "Invoice Payment")

- Wallet balance now tracks to that ladger account

Account Reconciliation

Ensure your records match reality.

Weekly Reconciliation

- Go to Wallets → Blockchain Import → Select wallet

- Select Reports

- BlockPeer shows:

- Blockchain Balance (what we recorded)

- Actual Balance (what We synced)

- Difference (should be $0)

- If difference exists, see "Reconciling Differences"

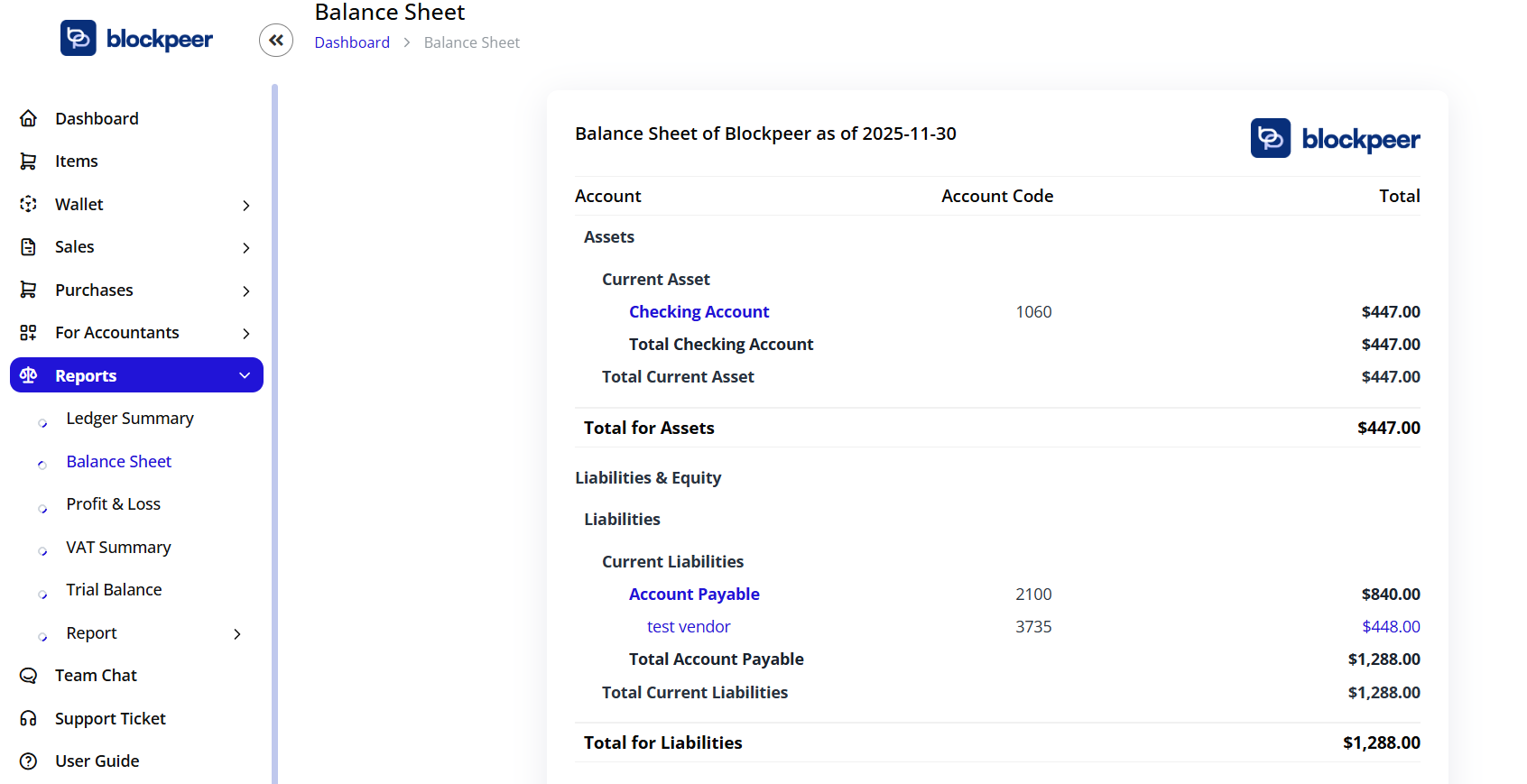

Monthly Close

- Go to Reports → Balance Sheet

- Select month to close

- Review all accounts for that period

- Check all transactions are recorded

- Verify balance sheet balances (Assets = Liabilities + Equity)

Reconciling Differences

If actual balance ≠ book balance:

-

Check pending transactions

- Deposits might take days to clear

- Withdrawals might be pending

- Check transaction status

-

Review recent transactions

- Did you miss recording something?

- Are fees accounted for?

- Check wallet for unrecorded transfers

-

Add adjustment entry

- If discrepancy is small (likely fees or rounding):

- Go to Accounting → New Transaction

- Type: Adjustment

- Debit or credit the difference account

- Add note explaining

-

Investigate discrepancies

- Large differences = likely data issue

- Check wallet directly

- Verify transactions are syncing

- Contact support if needed

Multi-Currency Accounts

For international businesses:

Setting Up

- Go to Settings → Organization Setup

- Add supported currencies

- Set exchange rate source (automatic or manual)

- Click Save

Using Multi-Currency Accounts

- When creating account, select currency

- Balance shows in that currency

- In reports, see both currency value and converted value

Exchange Rate Management

- Go to Settings → Exchange Rates

- View current rates

- Can set manual rates if needed

- Rates update automatically if using auto-update

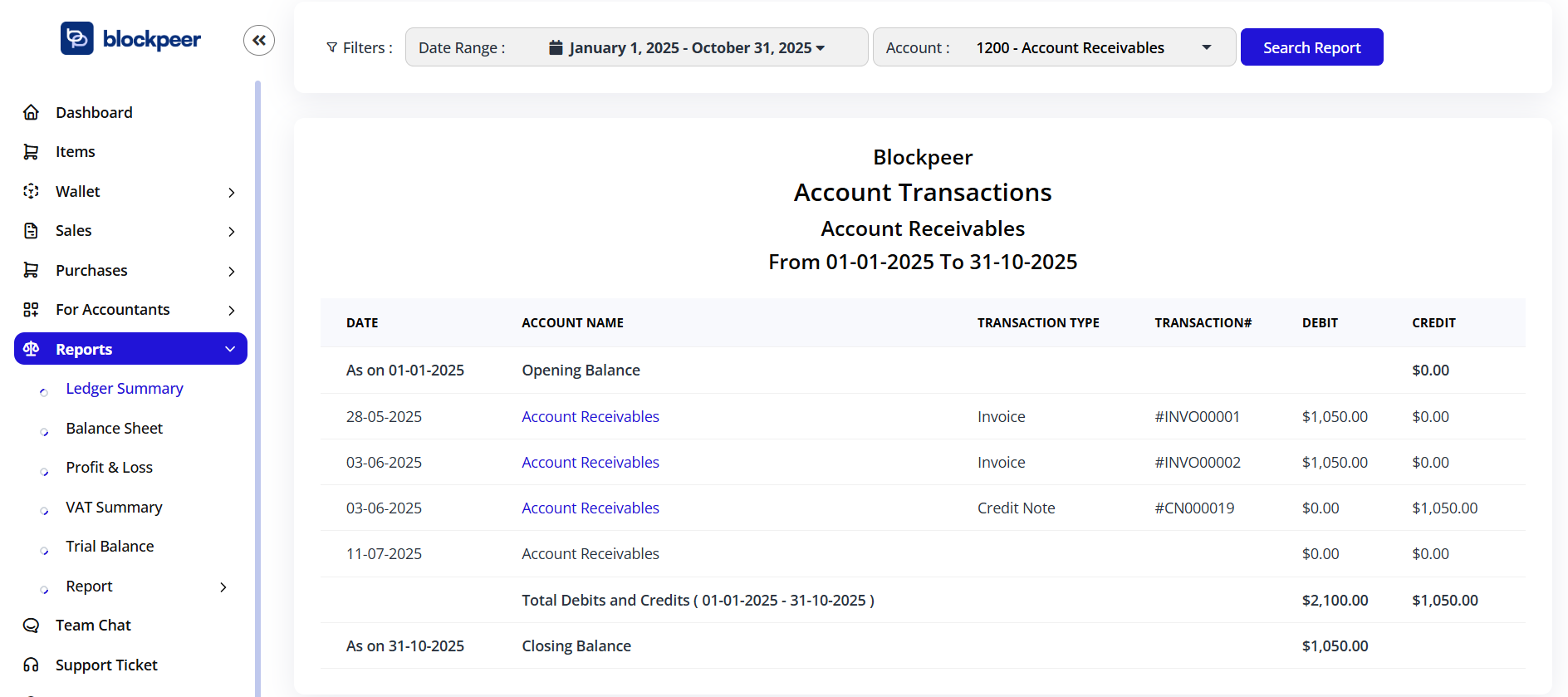

Account Reports

Account Statement

See all transactions for one account:

- Go to Reports → Ladger Summary

- Find account, click to view

- Click Account Statement

- Select date range

- See all transactions in chronological order

- Export to PDF

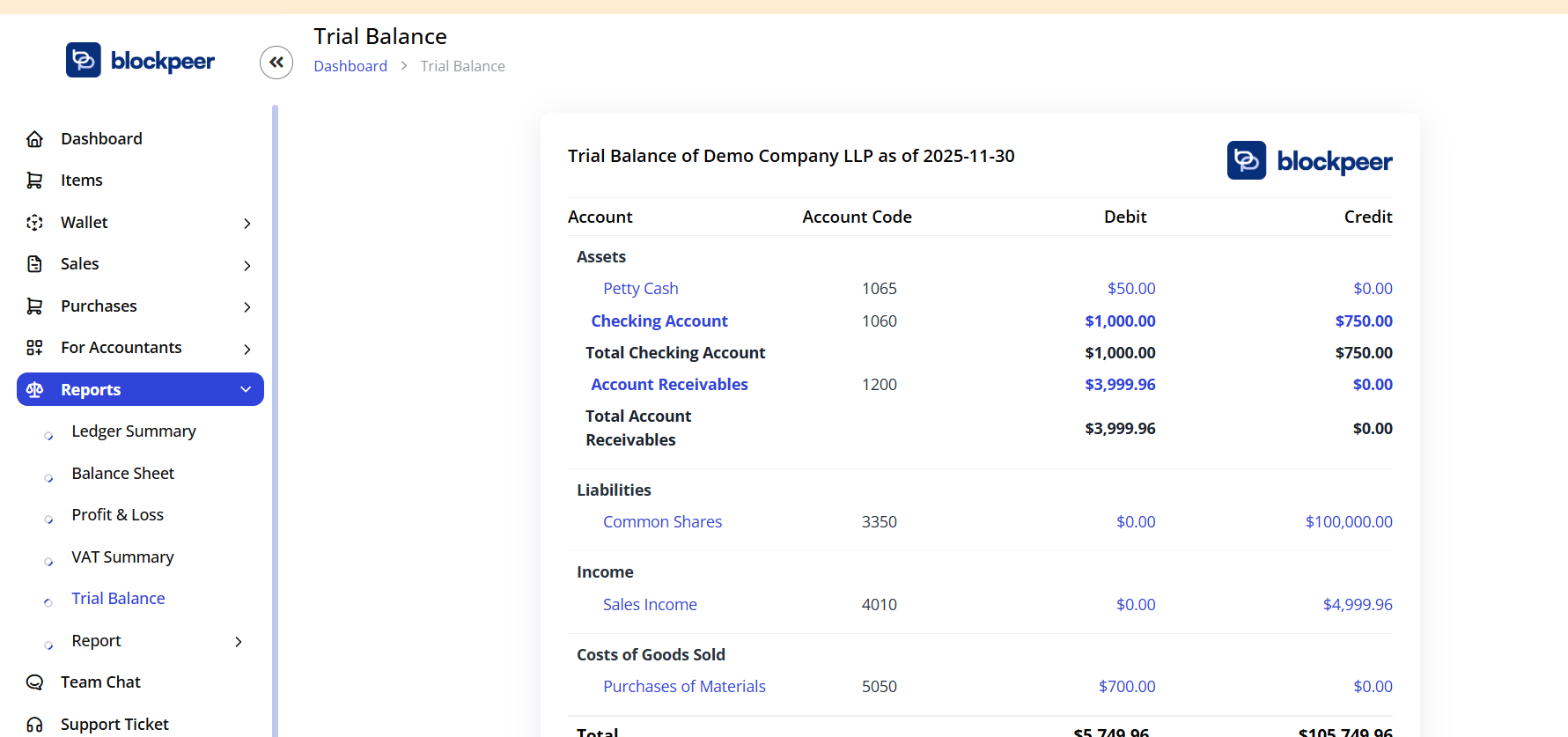

Trial Balance

Verify accounting equation (Assets = Liabilities + Equity):

Verify accounting equation (Assets = Liabilities + Equity):

- Go to Reports → Trial Balance

- Select as-of date

- See all accounts with debit/credit balances

- Total debits should = Total credits