Getting Started

Initial Setup

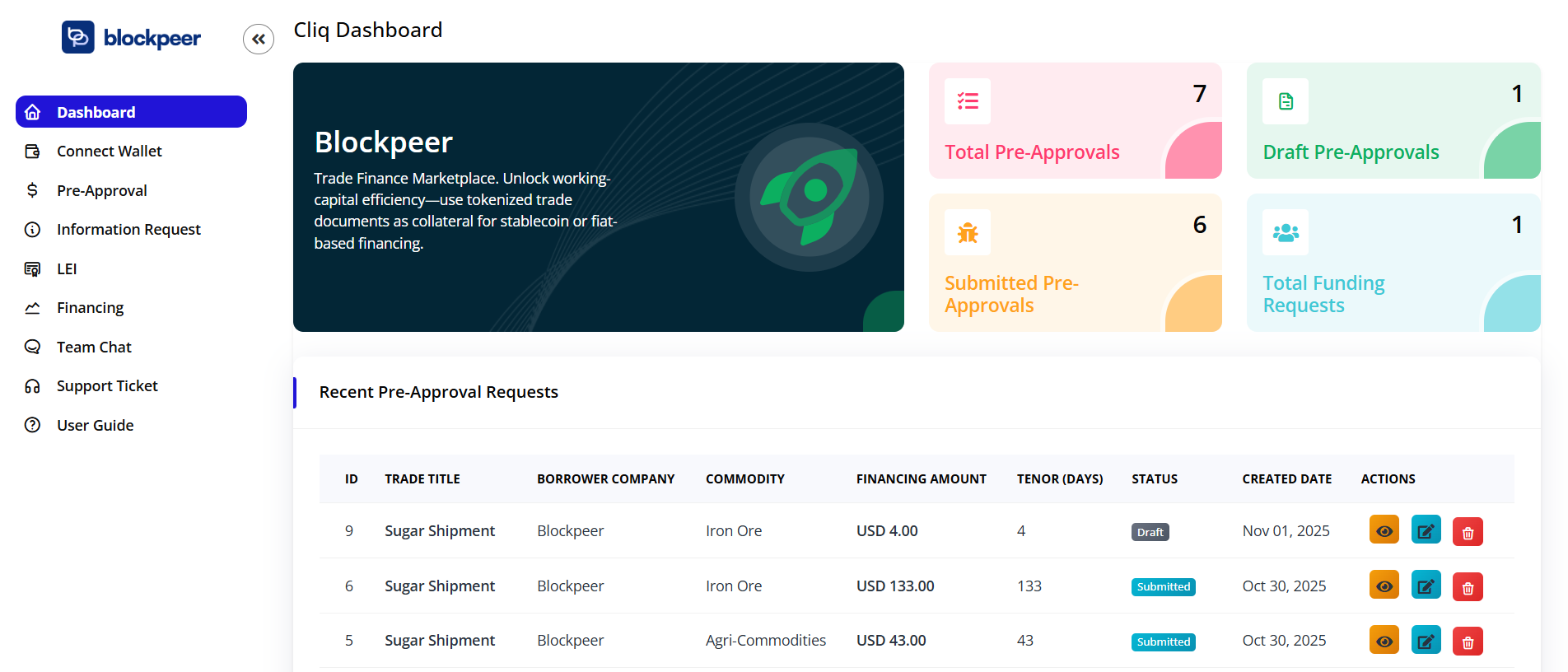

Step 1: Access CLIQ Trade Finance

- Log in to your BlockPeer account

- From the module selection screen, click on CLIQ Trade Finance

- You'll be taken to the CLIQ dashboard

Step 2: Understanding the Dashboard

!

The CLIQ dashboard provides a comprehensive overview of your trade finance activities:

- Pre-Approval Requests: View and manage trade finance pre-approval submissions

- Information Requests: Track investor inquiries and document sharing

- LEI: To check Company Legal Entity Identifier

- Financing: Monitor active financing requests and settlements

Step 3: Company Profile Setup

Before initiating any trade finance requests, ensure your company profile is complete:

- Click your Avatar (top-right)

- Navigate to Organization Settings

- Complete required information:

- Company legal name and registration details

- LEI (Legal Entity Identifier) if available

- Business address and contact information

- Banking details and preferred currency

- Click Save Profile

Quick Start Guide

For Companies (Requesting Finance)

- Submit Pre-Approval: Create a trade finance pre-approval request with basic trade details

- Respond to Information Requests: Share additional documentation when investors express interest

- Create LEI Financing Request: Submit formal financing request once pre-approved

- Negotiate Terms: Communicate with investors on ROI and settlement terms

- Finalize Agreement: Complete the financing agreement and receive funds

For Investors

- Browse Opportunities: Review pre-approval requests on the dashboard

- Request Information: Express interest and request additional documentation

- Submit ROI Proposal: Update financing terms with your proposed ROI

- Communicate: Discuss terms directly with companies

- Approve Financing: Finalize and fund approved trade finance requests

Navigation Overview

- Dashboard: Central hub for all trade finance activities

- Pre-Approval: Manage trade finance pre-approval requests

- Information Requests: Handle document sharing and investor inquiries

- LEI Financing: Create and manage financing requests and settlements

Best Practices

- Complete your profile thoroughly before submitting requests

- Respond promptly to information requests to maintain investor interest

- Keep all trade documentation organized and readily available

- Communicate clearly with investors during negotiation

- Review all terms carefully before finalizing agreements

Troubleshooting

Q: I can't access the CLIQ module A: Ensure you have the necessary permissions. Contact your administrator to grant CLIQ module access.

Q: My verification is taking longer than expected A: Verification typically takes 24-48 hours. If delayed, contact support with your reference number.

Q: How do I know if an investor is interested? A: You'll receive an information request notification when an investor wants to learn more about your trade finance opportunity.

Q: Can I edit my pre-approval request after submission? A: Pre-approval requests can be edited before investor engagement. Once information requests are received, contact the investor to discuss modifications.