ePromissory Note

Overview

ePromissory Note (also known as eBill of Exchange or eBoE) is an electronic version of a promissory note or bill of exchange. It's a legally binding digital document that represents a promise to pay a specified amount at a specified time, secured on blockchain and verifiable via TradeTrust.

What is ePromissory Note?

Traditional Promissory Note

A promissory note is:

- A written promise to pay

- Specified amount of money

- At specified future date

- To specified party (payee/beneficiary)

- Negotiable instrument (can be transferred)

Electronic Promissory Note

ePromissory Note digitalizes this:

- Blockchain-Based: Stored on immutable ledger

- Legally Equivalent: Same legal status as paper

- Transferable: Digital endorsement and transfer

- Verifiable: TradeTrust verification

- Negotiable: Can be traded, factored, discounted

- Secure: Tamper-proof, traceable

Key Components

Parties Involved:

Drawer:

- Party creating the note

- Promising to pay

- Debtor/buyer

- Your company details

Drawee (Optional):

- Party responsible for payment

- Bank or financial institution

- Third-party payer

Beneficiary:

- Party receiving payment

- Creditor/seller

- Payee

DNS:

- Your verified domain

- Links to token registry

- Enables TradeTrust verification

Use Cases

Trade Credit:

- Extend credit to buyers

- Deferred payment terms

- International trade financing

- Supplier credit

Invoice Discounting:

- Sell promissory notes to financiers

- Receive early payment

- At a discount

- Working capital solution

Letter of Credit Alternative:

- Digital trade instruments

- Reduced banking costs

- Faster processing

- Blockchain verified

Supply Chain Finance:

- Multi-tier financing

- Supplier early payment

- Buyer extended terms

- Financier involvement

Prerequisites

Before creating ePromissory Notes:

- ✅ Configuration completed

- ✅ Wallet connected

- ✅ Token registry created

- ✅ DNS verified and added

- ✅ Sufficient gas tokens

- ✅ Understanding of promissory notes

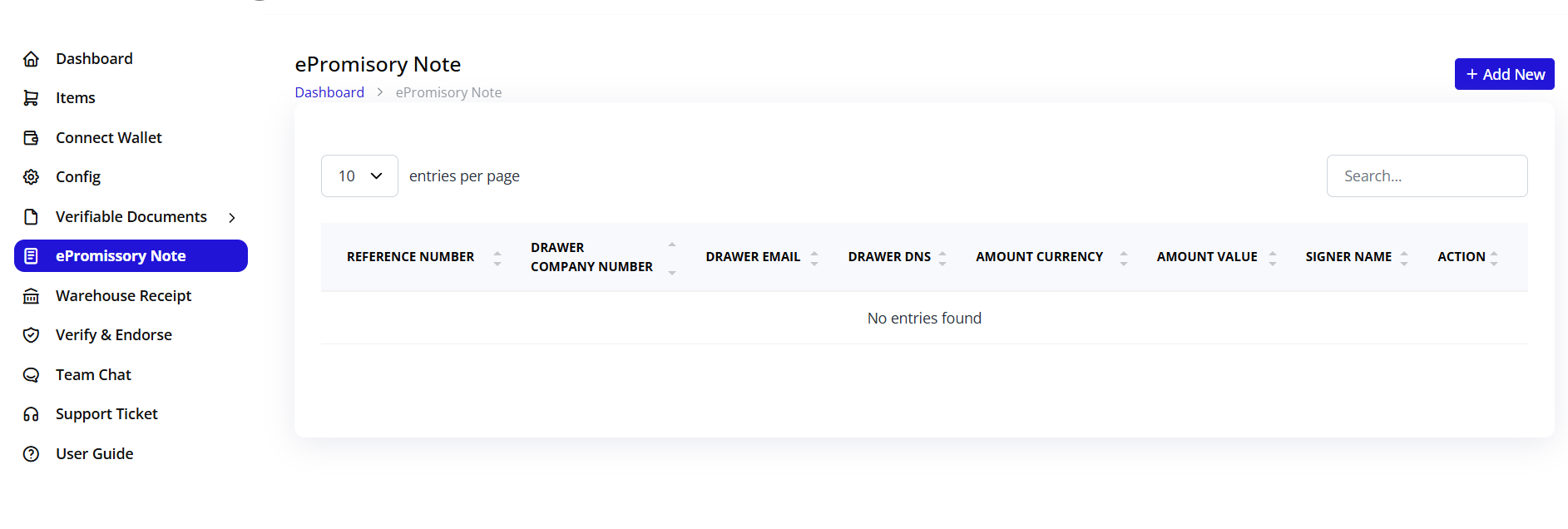

Accessing ePromissory Note

- Click ePromissory Note in sidebar

- ePromissory Note module opens

- List of existing notes displayed (if any)

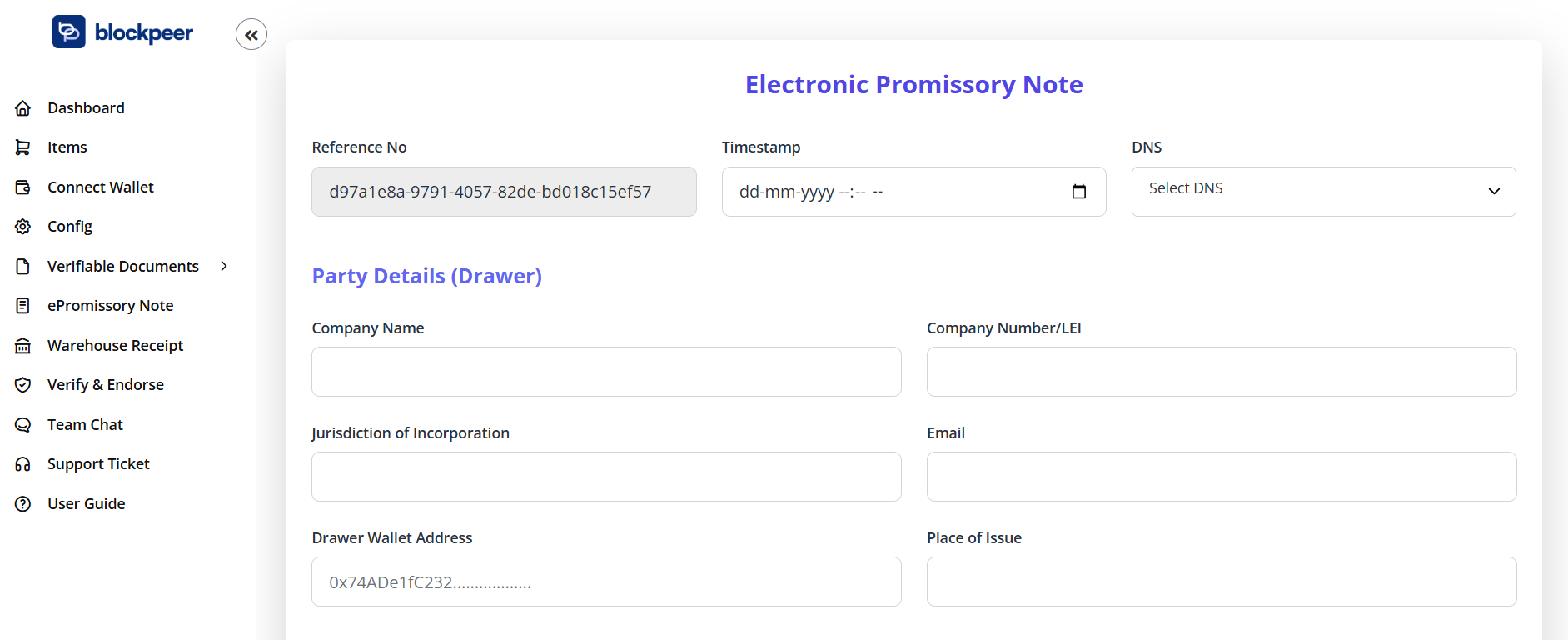

Creating ePromissory Note

Step 1: Initiate Creation

- Click + Create New or Create ePromissory Note button

- Create form opens

- Breadcrumb: Dashboard > ePromissory Note > Create

Step 2: Network and Wallet

Top-Right Controls:

Select Network:

- Dropdown showing current network

- Must match token registry network

- Cannot change after issuance

Connect Wallet:

- Blue button

- Ensure wallet connected

- Required for blockchain transaction

Step 3: Reference Number and Timestamp

Reference No: 68996744-93b7-4596-8d60-3bdf3a387296

- Auto-generated unique reference

- UUID format

- Identifies this specific note

- Used for tracking

- Cannot be changed

- Blockchain reference

Timestamp:

- Date and time picker

- Format: dd-mm-yyyy --:-- --

- When note was created

- Can set to current or specific time

- Important for legal validity

- Calendar picker available

DNS:

- Dropdown: "Select DNS"

- Choose your verified domain

- Required for TradeTrust verification

- Must be configured domain

- Links note to your identity

Step 4: Party Details (Drawer)

The Drawer is the party creating and signing the promissory note (typically the buyer/debtor).

Company Name:

- Text input field

- Legal name of drawer company

- Your company or customer company

- Full legal entity name

- As per registration documents

Company Number/LEI:

- Company registration number

- Or Legal Entity Identifier (LEI)

- Unique company identifier

- Tax ID or business number

- Required for verification

Jurisdiction of Incorporation:

- Text input field

- Where company is registered

- Country or state

- Legal jurisdiction

- Example: "Delaware, USA" or "England and Wales"

Email:

- Company email address

- Contact for drawer

- Official company email

- Used for notifications

Drawer Wallet Address:

- Blockchain wallet address

- Where drawer will sign

- 0x... format

- Must be valid address

- Drawer's identity on blockchain

Place of Issue:

- Text input field

- Where note is issued

- City and country

- Legal jurisdiction

- Example: "New York, USA"

Step 5: Drawee Details (Optional)

What is Drawee?

The drawee is the party responsible for payment.

Amount Details:**

Principal Amount:

- Numeric input

- Amount to be paid

- In specified currency

- Main obligation amount

- Example: 50,000

Currency:

- Dropdown selection

- USD, EUR, GBP, JPY, etc.

- Or cryptocurrency (USDT, USDC)

- Fiat or digital currency

- Payment denomination

Amount in Words:

- Auto-populated or manual entry

- Spelled out amount

- Legal requirement

- Example: "Fifty Thousand US Dollars"

- Prevents alteration

Step 8: Payment Terms

Issue Date:

- Date picker

- When note is created

- Starting date for terms

- Format: dd-mm-yyyy

Maturity Date:

- Date picker

- When payment is due

- Final payment date

- Must be after issue date

- Calculates tenor

Tenor/Term:

- Days between issue and maturity

- Auto-calculated

- Example: 90 days, 180 days

- Payment period

- Can be: "At sight", "30 days after sight", "On demand"

Interest Rate (Optional):

- Percentage field

- Annual interest rate

- If interest-bearing note

- Example: 5% per annum

- Leave blank if no interest

Interest Calculation Method:

- Simple interest

- Compound interest

- Daily, monthly calculation

- Specified in note terms

Step 9: Payment Details

Payment Instructions:

Payment Method:

- Bank transfer

- Cryptocurrency transfer

- Check

- Other specified method

Payment Address/Account:

- Bank account details

- Crypto wallet address

- Where to send payment

- Include all necessary details

Bank Details (if applicable):

- Bank name

- Account number

- SWIFT/BIC code

- Routing number

- Account holder name

Crypto Details (if applicable):

- Wallet address

- Network/chain

- Token type

- Payment instructions

Step 10: Terms and Conditions

Standard Clauses:

Payment Terms:

- When payment is due

- Grace period if any

- Late payment penalties

- Default interest rate

Place of Payment:

- City and country

- Legal jurisdiction

- Where payment should be made

Governing Law:

- Which jurisdiction's law applies

- Legal framework

- Dispute resolution location

- Example: "Laws of New York State"

Additional Terms:

- Special conditions

- Warranties

- Representations

- Other agreements

Notes Section:

- Free text area

- Additional information

- Special instructions

- References to contracts

Step 11: Supporting Documents

Attachments (Optional):

Upload supporting documents:

- Purchase order

- Sales contract

- Invoice

- Delivery documents

- Previous correspondence

File Upload:

- Click to browse

- Drag and drop

- Multiple files supported

- PDF, images, documents

Step 12: Review Before Issuance

Pre-Issuance Checklist:

- ✓ All party details complete and accurate

- ✓ Amounts correct (numbers and words match)

- ✓ Dates are logical (maturity after issue)

- ✓ Payment terms clearly specified

- ✓ Payment instructions complete

- ✓ DNS domain selected

- ✓ Reference number generated

- ✓ Terms and conditions included

- ✓ Supporting documents attached

- ✓ Reviewed for errors

Common Errors to Avoid:

- Mismatched amounts (numbers vs words)

- Incorrect party information

- Invalid dates

- Missing payment details

- Wrong jurisdiction

- Typos in company names

Step 13: Save or Issue

Action Buttons:

Save as Draft:

- Gray/white button

- Saves without issuing to blockchain

- Can edit later

- Not legally binding yet

- Status: Draft

Issue ePromissory Note:

- Blue button

- Publishes to blockchain

- Legally binding

- Cannot edit after

- Requires gas fee

Cancel:

- Discards changes

- Returns to list

- No data saved

Issuing ePromissory Note

Blockchain Transaction

When you click "Issue":

-

Wallet Popup Appears

- Shows transaction details

- Gas fee estimate

- Network confirmation

- Review all details

-

Transaction Details Show:

- To: Token registry address

- Data: Note details hash

- Gas Fee: Transaction cost

- Network: Selected blockchain

-

Approve in Wallet

- Click "Confirm"

- Transaction submitted

- Hash generated

- Pending confirmation

-

Wait for Confirmation

- Typically 15-60 seconds

- Progress indicator shows

- Don't close browser

- Multiple confirmations needed

-

Issuance Complete

- Success message appears

- Note status: Issued

- Blockchain transaction hash provided

- Token ID generated

- Note is now live

What Gets Recorded on Blockchain

On-Chain Data:

- Unique token ID

- Reference number

- Issue date and maturity date

- Principal amount

- Parties' wallet addresses

- Hash of document content

- Token registry link

- Timestamp

Off-Chain Data (Linked):

- Full party details

- Complete terms and conditions

- Supporting documents

- Additional notes

- Accessible via document hash

Legal Effect of Issuance

Once issued:

- Legally Binding: Enforceable promise to pay

- Immutable: Cannot be altered

- Verifiable: Anyone can verify authenticity

- Transferable: Can be endorsed and transferred

- Negotiable: Can be traded or factored

- Court Admissible: Blockchain proof accepted

Managing ePromissory Notes

ePromissory Note List

Table Columns:

REFERENCE NUMBER:

- Unique identifier

- UUID format

- Clickable to view details

DRAWER COMPANY NUMBER:

- Drawer's company ID

- Legal entity identifier

DRAWER EMAIL:

- Contact email

- Drawer's email address

DRAWER DNS:

- Linked domain

- Your verified DNS

AMOUNT CURRENCY:

- Currency code

- USD, EUR, crypto, etc.

AMOUNT VALUE:

- Principal amount

- Numeric value

- In specified currency

SIGNER NAME:

- Who signed the note

- Wallet address or name

ACTION:

- Quick action buttons

- View, download, verify

ePromissory Note Status

Status Flow:

Draft

↓

Issued

↓

Endorsed (if transferred)

↓

Matured (on maturity date)

↓

Paid

Or:

Draft

↓

Issued

↓

Dishonored (if not paid at maturity)

Status Definitions:

Draft:

- Being prepared

- Not on blockchain

- Can edit

- No legal effect

Issued:

- Published to blockchain

- Legally binding

- Ownership established

- Awaiting maturity

Endorsed:

- Transferred to another party

- New owner recorded

- Blockchain transfer complete

- Original issuer still liable

Matured:

- Past maturity date

- Payment now due

- Can demand payment

- Interest may apply

Paid:

- Payment received

- Obligation fulfilled

- Note discharged

- Recorded on blockchain

Dishonored:

- Payment not received at maturity

- Default situation

- Legal action possible

- Recorded on blockchain

Viewing ePromissory Note Details

Opening Note:

- Click reference number or View button

- Full note details display

- All information visible

Detail Sections:

Header:

- Electronic Promissory Note title

- Reference number

- Status badge

- Timestamp

- DNS domain

Party Details:

- Drawer information

- Drawee information (if applicable)

- Beneficiary information

- All contact details

Financial Terms:

- Principal amount

- Currency

- Interest rate (if any)

- Total amount due

Date Information:

- Issue date

- Maturity date

- Tenor/term

- Current status

Payment Instructions:

- Payment method

- Bank/crypto details

- Where to pay

- How to pay

Terms and Conditions:

- Full legal terms

- Governing law

- Additional clauses

- Special conditions

Blockchain Information:

- Transaction hash

- Block number

- Token ID

- Verification link

- Smart contract address

Attachments:

- Supporting documents

- Download links

- Document previews

Action Buttons on Note

Download:

- Download as PDF

- TradeTrust format (.tt file)

- Print-ready version

- Includes QR code for verification

Verify:

- Quick verify button

- Check TradeTrust status

- Verify on blockchain

- Generate verification report

Endorse/Transfer:

- Transfer ownership

- Digital endorsement

- To another party

- Blockchain transaction required

Record Payment:

- Mark as paid

- Enter payment details

- Payment date

- Transaction reference

Print:

- Print physical copy

- For records

- Legal backup

- Traditional archive

Endorsement and Transfer

What is Endorsement?

In Traditional Promissory Notes:

- Signature on back of note

- Transfers ownership

- New holder can claim payment

- Chain of endorsements

In ePromissory Notes:

- Digital signature

- Blockchain transfer

- New wallet owner recorded

- Transparent ownership chain

Why Transfer/Endorse?

Invoice Factoring:

- Sell note to factor

- Receive immediate payment

- At a discount

- Factor collects at maturity

Trade Finance:

- Banks purchase notes

- Provide working capital

- Supplier gets early payment

- Bank profits from discount

Investment:

- Sell to investors

- Yield-bearing instrument

- Secondary market

- Liquidity option

Transfer Process

Step 1: Initiate Transfer

- Open issued note

- Click Endorse or Transfer button

- Transfer form appears

Step 2: Enter Transfer Details

Recipient Information:

- Recipient name

- Wallet address (0x...)

- Email notification (optional)

- Transfer reason

Transfer Type:

- Full transfer: All rights transferred

- Partial: Split ownership (if supported)

- With recourse: You remain liable

- Without recourse: No liability

Transfer Terms:

- Transfer date

- Consideration amount (if selling)

- Conditions

- Special terms

Step 3: Approve Blockchain Transaction

- Review transfer details

- Wallet popup appears

- Approve transaction

- Pay gas fee

- Wait for confirmation

Step 4: Transfer Complete

- Ownership transferred on blockchain

- Recipient becomes new holder

- You receive confirmation

- Transfer recorded in history

- Recipient can now claim payment

Transfer History

Tracking Transfers:

Each note maintains complete history:

- Original issuer

- All subsequent owners

- Transfer dates

- Blockchain transaction hashes

- Current owner

Transparency:

- Anyone can view transfer chain

- Verifiable ownership

- No disputes

- Clear audit trail

Payment and Settlement

Recording Payment

When Payment is Received:

-

Open the note

-

Click Record Payment

-

Enter payment information:

- Payment date

- Amount received

- Payment method

- Reference/transaction ID

- Payer details

-

Upload proof (optional):

- Bank statement

- Transaction screenshot

- Payment confirmation

- Receipt

-

Submit payment record

-

Note status updates to "Paid"

Partial Payments

If Accepting Partial Payments:

- Record each payment separately

- Running balance maintained

- Shows amount remaining

- Multiple payment records

- Final payment completes note

Payment Verification

On Blockchain:

For crypto payments:

- Payment transaction on blockchain

- Verifiable by anyone

- Immutable proof

- Automatic detection possible

Traditional Payments:

For bank transfers:

- Manual recording

- Upload bank confirmation

- Reference numbers

- Audit trail maintained

Dishonored Notes

If Payment Not Received:

At Maturity:

- Note automatically marked "Matured"

- Grace period (if specified)

- If still unpaid, mark "Dishonored"

Recording Dishonor:

- Click Record Dishonor

- Enter dishonor details:

- Reason for non-payment

- Attempts to collect

- Communication history

- Blockchain transaction

- Status: Dishonored

Legal Recourse:

- Blockchain proof of obligation

- Dishonor recorded

- Legal action possible

- Court-admissible evidence

TradeTrust Verification

Verifying ePromissory Notes

Why Verify:

- Prove authenticity

- Check for tampering

- Verify issuer

- Legal validation

- Due diligence

Verification Process:

-

Download Note

- Click Download button

- Save .tt or .json file

-

Go to TradeTrust.io

- Visit https://tradetrust.io

- Click "Verify Documents"

-

Upload Note File

- Drag and drop file

- Or browse to select

- Upload to verifier

-

View Verification Results

Verification Checks:

✅ Document Integrity

- Has document been tampered with?

- Hash matches blockchain

- Content unchanged

✅ Issuer Identity

- DNS verification

- Domain matches token registry

- Legitimate issuer

✅ Document Status

- Currently valid?

- Not revoked

- Ownership confirmed

Verification for Third Parties

Banks and Financiers:

- Must verify before purchasing

- Confirms authenticity

- Risk assessment

- Compliance requirement

Verification Information Shown:

- Issuer name and domain

- Issue date

- Amount and currency

- Current owner

- Transfer history

- Blockchain details

Building Trust:

- Independent verification

- No need to trust issuer

- Blockchain proof

- Globally recognized

Interest-Bearing Notes

Adding Interest

When Creating Note:

- Specify interest rate

- Choose calculation method:

- Simple interest

- Compound interest

- Daily accrual

- Monthly accrual

Interest Calculation:

Simple Interest:

Interest = Principal × Rate × Time

Example:

- Principal: $50,000

- Rate: 5% per annum

- Term: 90 days

Interest = $50,000 × 0.05 × (90/365) = $616.44

Total Due = $50,000 + $616.44 = $50,616.44

Compound Interest:

Total = Principal × (1 + Rate/n)^(n×Time)

Interest = Total - Principal

Interest Terms

Specify in Note:

- Interest rate percentage

- Calculation method

- Compounding frequency

- Day count convention (30/360, actual/365)

- Interest payment schedule

Late Payment Interest:

- Default interest rate

- Penalty rate

- When it applies

- How calculated

Legal Considerations

Legal Validity

Electronic Promissory Notes:

- Legally equivalent to paper notes

- Recognized under:

- UNCITRAL MLETR (Model Law on Electronic Transferable Records)

- Uniform Commercial Code (USA)

- Bills of Exchange Act (UK and Commonwealth)

- National electronic transaction laws

Requirements for Validity:

- In Writing: Electronic form acceptable

- Signed: Digital signature valid

- Unconditional Promise: To pay

- Fixed Amount: Specific sum

- Payable to Order or Bearer: Negotiable

- Payable on Demand or at Definite Time: Clear terms

Jurisdiction Considerations

Governing Law:

- Specify in note

- Which country's law applies

- Important for enforcement

- Dispute resolution

Cross-Border Notes:

- International law applies

- Convention on International Bills

- Hague Securities Convention

- Local law compliance

Dispute Resolution

In Case of Dispute:

Blockchain Evidence:

- Immutable proof

- Timestamped records

- Clear ownership

- Transfer history

Arbitration Clause:

- Consider including

- Faster resolution

- Lower cost

- Enforceable internationally

Court Proceedings:

- Blockchain evidence admissible

- TradeTrust verification

- Clear documentation

- Strong legal position

Advanced Features

Conditional Notes

Conditional Payment:

Some notes may include:

- Payment upon delivery

- Upon inspection approval

- Subject to contract completion

- Other conditions precedent

Smart Contract Integration:

- Automatic payment release

- When conditions met

- Blockchain verification

- Reduces disputes

Multi-Party Notes

Multiple Beneficiaries:

- Split payment

- Multiple payees

- Proportional distribution

- Complex arrangements

Co-Makers/Guarantors:

- Joint liability

- Multiple drawers

- Guarantee structure

- Enhanced security

Note Chains

Linked Notes:

- Series of notes

- Installment payments

- Structured finance

- Complex transactions

Parent-Child Notes:

- Master note

- Sub-notes

- Hierarchical structure

- Consolidated tracking

Integration with Other Modules

E-Invoice Connection

Invoice-Backed Notes:

- Create note from invoice

- Link to specific invoice

- Payment against invoice

- Integrated workflow

Process:

- Create eInvoice

- Buyer creates ePromissory Note

- Note references invoice

- At maturity, invoice marked paid

Trade Finance Integration

With Banks:

- Submit note for financing

- Bank verification via TradeTrust

- Approval process

- Fund disbursement

Factoring Companies:

- Upload note for factoring

- Instant verification

- Quick approval

- Early payment received

Reporting and Analytics

ePromissory Note Reports

Portfolio View:

- All outstanding notes

- Total value

- Maturity schedule

- Risk assessment

Aging Report:

- Notes by maturity date

- Overdue notes

- Payment collection priority

- Cash flow forecasting

Transfer Report:

- All endorsements

- Current holders

- Transfer history

- Factoring analysis

Financial Analysis

Cash Flow Projection:

- Expected receipts

- By maturity date

- Scenario analysis

- Planning tool

Discount Analysis:

- If selling notes

- Calculate discount rate

- Compare offers

- Optimize timing

Best Practices

Creating Notes

Clear Terms:

- Unambiguous language

- Specific amounts and dates

- Clear payment instructions

- Complete party details

Proper Documentation:

- Attach supporting documents

- Reference underlying transaction

- Include all agreements

- Complete audit trail

Accurate Information:

- Verify all party details

- Double-check amounts

- Confirm dates

- Review before issuing

Managing Notes

Track Maturity:

- Calendar reminders

- Follow up before maturity

- Prepare for collection

- Prompt payment requests

Maintain Records:

- Download copies

- Backup blockchain hashes

- Keep correspondence

- Document everything

Professional Communication:

- Clear payment reminders

- Professional tone

- Document all interactions

- Escalate appropriately

Security

Wallet Security:

- Secure private keys

- Use hardware wallet for high values

- Multi-signature for large notes

- Regular security audits

Due Diligence:

- Verify counterparties

- Check creditworthiness

- Assess payment risk

- Document assessment

Troubleshooting

Q: Transaction failed when issuing note A: Check wallet has sufficient gas tokens. Increase gas limit. Verify network connection. Try again with higher gas price.

Q: Cannot transfer note A: Ensure note is in "Issued" status. Verify recipient wallet address. Check you are current owner. Ensure sufficient gas fee.

Q: Note not verifying on TradeTrust A: Confirm DNS is properly configured. Re-download the .tt file. Try verifying again. Check file format is correct.

Q: Want to modify issued note A: Cannot modify issued notes (blockchain immutable). Must cancel and reissue. Or create amended note referencing original.

Q: Drawer disputes note A: Blockchain provides proof of creation. Transaction hash is evidence. Legal action may be needed. Consult legal counsel.

Q: Payment made but note still shows unpaid A: Manually record payment. Provide payment proof. Update status. Blockchain transactions may be pending.

Q: Lost access to note A: Notes are on blockchain permanently. Recover wallet to regain access. Use blockchain explorer to view. Contact support for help.

Frequently Asked Questions

Q: Is ePromissory Note legally binding? A: Yes, in jurisdictions recognizing electronic negotiable instruments. Same legal effect as paper promissory notes.

Q: Can I enforce payment legally? A: Yes. ePromissory Note is evidence of debt. Blockchain proof is admissible in court. Legal enforcement same as paper.

Q: How much does it cost? A: Only blockchain gas fees. Typically $0.10-$2 per note. No monthly fees or subscription costs.

Q: Can I sell/transfer the note? A: Yes! That's the key feature. Transfer via blockchain. New owner can claim payment at maturity.

Q: What if drawer doesn't pay? A: Record dishonor on blockchain. Take legal action if needed. Blockchain proof supports your case.

Q: Do I need the other party's permission to issue? A: Drawer (payer) creates the note. Beneficiary (payee) receives it. Both parties should agree to terms beforehand.

Q: Can I create note in any currency? A: Yes. Fiat currencies (USD, EUR, etc.) or cryptocurrencies. Specify in note. Payment in agreed currency.

Q: How long are notes stored? A: Forever on blockchain. Permanently accessible. Cannot be deleted. Always verifiable.

Q: What if I made a mistake? A: If draft, edit and correct. If issued, cannot change. Create new note or amendment. Blockchain records are permanent.

Q: Can banks accept ePromissory Notes? A: Yes. Many banks accept TradeTrust-verified notes. Check with your bank. Increasingly common for trade finance.

Summary

ePromissory Note brings negotiable instruments to the blockchain:

- ✅ Legally Binding: Same status as paper notes

- ✅ Transferable: Digital endorsement and transfer

- ✅ Verifiable: TradeTrust global verification

- ✅ Secure: Blockchain immutability

- ✅ Efficient: Instant transfers, no physical handling

- ✅ Cost-Effective: Minimal transaction fees

- ✅ Trade Finance Ready: Factoring and discounting enabled

Transform Trade Credit:

- Create ePromissory Note

- Issue to blockchain

- Transfer for financing

- Verify on TradeTrust

- Receive payment at maturity

- Digital trade future

Next: Learn about Warehouse Receipt for commodity financing