Financing - Funding Request

Overview

The Financing module is the core of CLIQ's trade finance system, where companies create formal financing requests and investors propose terms, negotiate ROI, and finalize funding agreements.

Understanding Financing

What is Financing?

Financing is the formal funding request process that occurs after:

- Create your financing request

- Investor will review

- Both parties are ready to discuss specific terms

- Formal financing agreement is needed

Financing Lifecycle

- Request Creation: Company creates financing request

- Investor Review: Investors evaluate the opportunity

- ROI Proposal: Investors update their proposed return on investment

- Negotiation: Both parties communicate and adjust terms

- Settlement: Final terms are agreed upon

- Approval: Financing is approved and funded

- Execution: Funds are disbursed according to agreement

Creating a Financing Request

Step 1: Navigate to Financing

- From CLIQ dashboard, click Financing

- Click + New Financing Request

- Connect your wallet

Step 2: Complete Financing Details

Trade Information

- Trade reference number (auto-populated from pre-approval)

- Trade description and commodity

- Buyer and seller details

- Country of origin and destination

Financing Terms

- Amount Required: Specific funding amount needed

- Currency: Select transaction currency

- Financing Tenure: Exact period (days/months)

- Proposed ROI: Your suggested investor return (optional)

- Repayment Terms: When and how funds will be repaid

- Security/Collateral: Assets offered as security

Payment Structure

- Payment milestones

- Disbursement schedule

- Repayment schedule

- Interest calculation method

Risk Mitigation

- Insurance coverage

- Letter of credit details

- Guarantees provided

- Collateral specifics

Step 3: Upload Required Documents

Step 4: Set Terms and Conditions

Configure financing terms:

- Negotiation Period: How long terms remain open (typically 7-30 days)

- Minimum ROI: Lowest acceptable investor return

- Maximum ROI: Highest you're willing to pay

- Auto-Accept Threshold: ROI at which you'll automatically accept

- Counter-Offer Rules: Your negotiation parameters

Step 5: Review and Submit

- Review all financing details thoroughly

- Verify document uploads are complete

- Check terms and thresholds

- Click Submit Financing Request

- Request is published to interested investors

Investor ROI Proposals

Receiving ROI Proposals

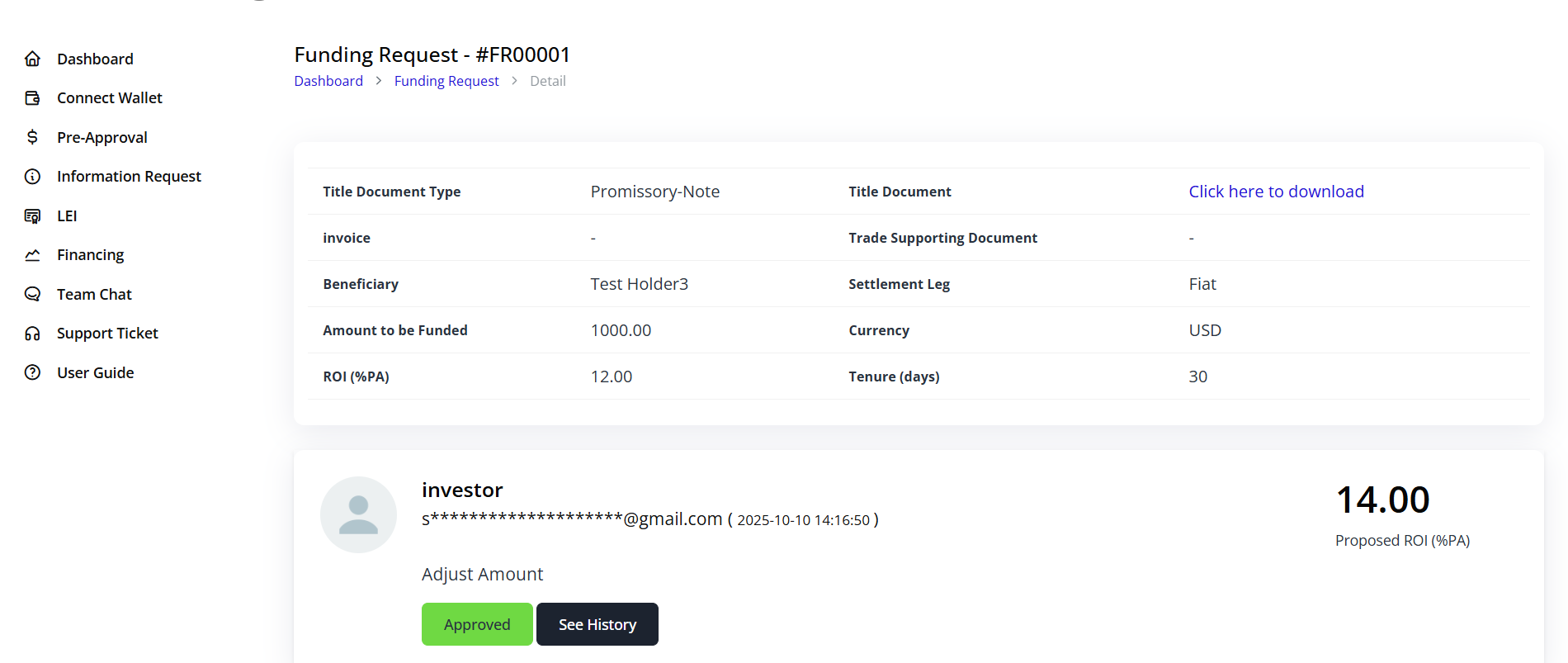

When investors respond to your financing request:

Proposal Components:

- Proposed ROI percentage

- Financing amount they're willing to provide

- Any conditions or requirements

- Timeline for funding

- Special terms or considerations

Viewing Proposals:

- Navigate to your financing request

- Click View Proposals tab

- See all investor proposals with:

- Investor name/ID

- Proposed ROI

- Amount offered

- Conditions

- Proposal date

Comparing Proposals

Use the comparison tool to evaluate:

- Total Cost: Calculate total interest and fees

- Timeline: Compare funding speed

- Terms: Review conditions and requirements

- Investor Profile: Check investor history and ratings

- Risk: Assess proposal security

ROI Negotiation Process

Negotiation Options:

-

Accept Proposal

- Click Accept on preferred proposal

- Confirm acceptance

- Move to settlement phase

-

Counter-Offer

- Click Counter on proposal

- Adjust ROI or terms

- Add message explaining your counter

- Submit counter-offer

-

Request Clarification

- Use messaging feature

- Ask questions about terms

- Request modifications

- Negotiate outside formal counter-offers

-

Decline Proposal

- Click Decline with reason

- Proposal is removed from active list

- Investor is notified

Negotiation Strategies

For Better Terms:

- Provide comprehensive documentation upfront

- Show strong financial position

- Highlight low-risk factors

- Offer additional security if possible

- Be flexible on non-critical terms

Red Flags to Watch:

- Unusually high ROI demands

- Unclear terms and conditions

- Requests for upfront payments

- Pressure for immediate decisions

- Lack of proper documentation

Settlement Process

Moving to Settlement

Once ROI is agreed upon:

-

Terms Confirmation

- Both parties review final terms

- All conditions are documented

- Timeline is set

- Responsibilities are clear

-

Legal Documentation

- Financing agreement is generated

- Terms and conditions document

- Repayment schedule

- Security agreements

-

Digital Signatures

- Both parties digitally sign agreements

- Documents are blockchain-recorded

- Tamper-proof record created

-

Verification Checks

- Final KYC/compliance checks

- Fund source verification

- Security validation

- Regulatory approvals

Settlement Status Tracking

Monitor settlement progress:

- ⏳ Pending Agreement: Finalizing terms

- ✍️ Awaiting Signatures: Documents ready for signing

- 🔍 Under Verification: Compliance checks in progress

- 💰 Funds in Escrow: Payment secured

- ✅ Completed: Financing active

Approval and Funding

Final Approval

Approval Steps:

- All documents signed and verified

- Compliance clearance received

- Funds transferred to escrow

- Final approval granted by both parties

- Financing marked as active

Post-Approval Actions:

- Funds are released according to disbursement schedule

- Monitoring begins for repayment milestones

- Regular status updates are provided

- Communication channels remain open

Best Practices

For Creating Financing Requests

- Ensure all information is accurate and complete

- Upload high-quality, legible documents

- Set realistic ROI expectations based on market rates

- Provide comprehensive risk mitigation details

- Be transparent about any potential issues

For Negotiating Terms

- Understand market ROI rates for your trade type

- Be prepared to justify your counter-offers

- Respond to proposals promptly

- Keep negotiations professional

- Document all agreed changes

For Settlement and Funding

- Review all documents carefully before signing

- Ensure you understand all terms and obligations

- Keep copies of all signed agreements

- Set up payment reminders

- Maintain good communication with investors

For Managing Active Financing

- Make payments on time

- Communicate proactively about any issues

- Keep financial records up to date

- Monitor your financing dashboard regularly

- Request modifications early if needed

Troubleshooting

Q: No investors are proposing ROI. What should I do? A: Review your terms - ROI expectations may be too low, amount too high, or risk factors need better mitigation. Consider adjusting terms or providing more documentation.

Q: Can I accept multiple proposals for partial funding? A: Yes, if your financing request allows for split funding. Ensure total doesn't exceed your requested amount.

Q: An investor isn't responding to my counter-offer A: Allow 48-72 hours for response. If no reply, the system auto-expires the negotiation, freeing you to accept other proposals.

Q: I need to cancel a financing request. Is this possible? A: Yes, before settlement. Click Cancel Request, provide reason, notify active negotiators. Cannot cancel after settlement begins.

Q: The ROI is higher than expected. Can I find better terms? A: You can decline proposals and wait for better offers, or continue negotiating. Market conditions and your risk profile affect ROI rates.

Q: What happens if I miss a repayment? A: Late fees may apply per your agreement. Contact investor immediately to discuss options. Repeated defaults can affect your credit rating in the platform.

Financing Request Checklist

Before submitting:

- ✓ Pre-approval completed and information requests satisfied

- ✓ LEI is active and verified

- ✓ All trade documents are current and complete

- ✓ Financing amount and tenure are finalized

- ✓ Repayment schedule is realistic and detailed

- ✓ Security/collateral is properly documented

- ✓ ROI range is competitive for your trade type

- ✓ Payment milestones are clearly defined

- ✓ Insurance and risk mitigation are in place

- ✓ Legal documents are reviewed

- ✓ Contact information is current

Additional Resources

- Trade Finance Calculator: Estimate costs and returns

- ROI Benchmarks: Industry-standard ROI rates

- Sample Agreements: Template financing agreements

- Support: Contact CLIQ support for financing assistance

- Training: Video tutorials on negotiation strategies